A cross market usage and attitude study

How Givaudan unlocked home care opportunities across Sub Saharan Africa through consumer insights

“The collaboration has been very strong. There are no deficiencies on Opeepl’s side. If delays occur, they are typically due to slower responses from our side or from the client. You are highly responsive and flexible. If we want changes, you implement them quickly without hesitation.

Timelines are consistently met, communication is clear, and the pricing is competitive. Compared to some local suppliers in South Africa, who are slower and significantly more expensive, Opeepl offers better value in terms of speed, flexibility, and cost efficiency.”

Kirsten Van Zyl

Senior CMI Manager at Givaudan

About Givaudan

Givaudan is a global leader in Fragrance and Flavor solutions. On the fragrance side, the company develops and supplies fragrance oils that are incorporated into consumer products manufactured by multinational FMCG companies.

Givaudan works with major brands such as Unilever, Colgate, Palmolive, and Reckitt. These companies produce home care and personal care products, while Givaudan provides scent solutions that enhance product performance and consumer appeal.

This case focuses on Givaudan’s Fragrance division in Sub Saharan Africa.

The challenge

Limited structured market understanding under tight client deadlines

Givaudan’s Sub Saharan Africa team identified a significant gap in structured market knowledge within the home care category, particularly in Nigeria.

A commercial lead responsible for Nigeria needed to present robust market insights to a client but lacked a clear understanding of local consumer behavior. Shortly after, colleagues covering Kenya and South Africa expressed similar needs. While South Africa was relatively more familiar, the team still required deeper, data driven validation across markets.

The key challenges were:

Limited structured data on consumer usage and attitudes in home cleaning

Inconsistent understanding across markets

Tight, client driven timelines

The need for credible, presentation ready insights

Givaudan required a fast, reliable research partner capable of delivering high quality insights without compromising accuracy.

The solution

A cross market Usage and Attitude Study

Opeepl conducted a quantitative Usage and Attitude Study across three Sub Saharan African markets.

Project Overview

Research type: Usage and Attitude Study

Objective: Understand consumer usage patterns and attitudes toward home cleaning products

Target audience: Main purchase decision makers of home cleaning products, individuals responsible for most or some household cleaning

Markets: South Africa, Nigeria, Kenya

Sample size: 750 interviews total, 250 per market

Quotas: City, gender, and age

Opeepl was selected due to its reliability, flexibility, speed, and competitive pricing. Given the compressed timeline, Givaudan needed a partner known for delivering accurate and error free outputs while remaining adaptable to changes.

Usage and Attitude Study

A usage and attitude study gives a real time understanding of how products are perceived and used by the consumers. By being aware of your products’ perceived trends in the market, you will be able to strengthen your market position by promptly undertaking products/services innovation or other initiatives.

The research

Market specific behaviours revealed critical differences

The study confirmed several initial assumptions but also uncovered important behavioural differences between markets.

One key example was bleach usage in dishwashing:

In South Africa, bleach usage in dishwashing is relatively common.

In Nigeria, this behaviour is not prevalent.

Prior to the study, Givaudan had proposed bleach related concepts to Nigerian clients. These proposals did not resonate, and the team struggled to understand why. The research clarified that consumer behavior simply did not exist at a meaningful scale in Nigeria.

This distinction significantly improved the team’s ability to tailor recommendations by market.

Beyond specific behaviours, the study provided:

A structured understanding of category penetration

Clarity on cleaning routines and product combinations

Identification of unmet needs and white space opportunities

Insight into portfolio gaps within client offerings

The outcome

Stronger client conversations and opportunity driven recommendations

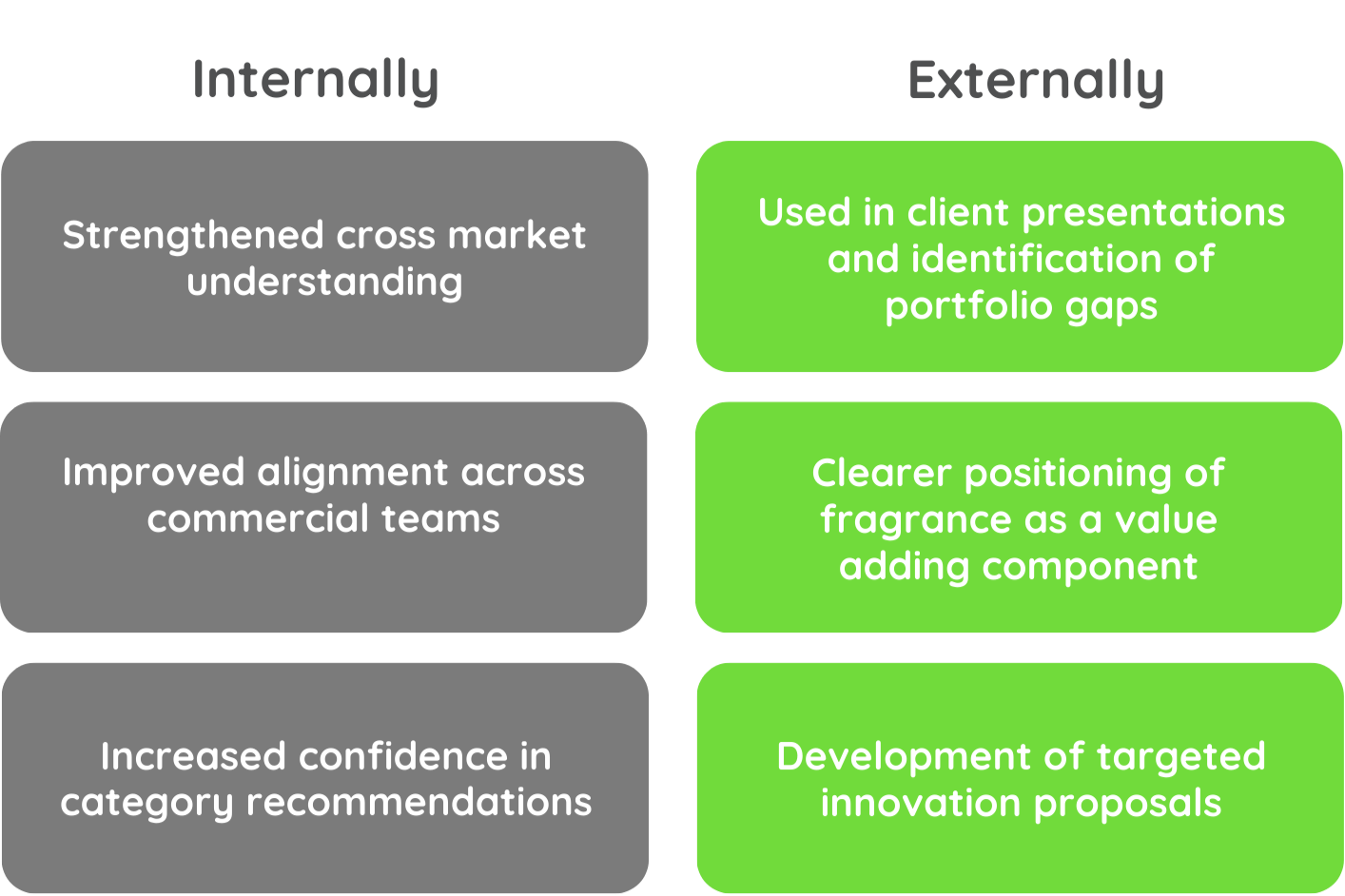

The research is now used both internally and externally.

The data enables Givaudan to approach clients with evidence-based recommendations, including opportunities where consumers are using solutions not currently represented in a client’s portfolio.

This has improved relevance, reduced misalignment, and strengthened strategic dialogue with multinational FMCG partners.